The markets in Northwest Arkansas and Southwest Missouri that the construction company Carson-Mitchell, Inc. serves are “booming,” says its President and CEO Chris Carson. Despite the coronavirus pandemic’s impact on its economy, construction “never really slowed, or stopped” in Florida, says Brett Strassel, Vice President of Operations for the West Palm Beach-based Hedrick Brothers Construction.

But like construction companies across the U.S., these firms have been struggling to keep pace with demand in their territories because they can’t find enough skilled labor.

On Thursday, Carson and Strassel participated in ZOOM call during which the Associated General Contractors of America (AGC) and Autodesk presented their ninth annual Workforce Survey, with new data—based on responses from more than 2,100 companies—that show the scope and impact of construction workforce shortages that have reached pre-pandemic levels and continue to be affected negatively by the lingering coronavirus.

Contractors are ready to hire more employees; finding them is the problem.

“We’re in an odd paradox,” said Stephen E. Sandherr, the association’s CEO. On one hand, the shortages, which predate the pandemic, along with supply-chain snags, are causing projects to be delayed. On the other hand, the pandemic “has been driving” the industry’s construction and workforce issues.

This morning, AGC reported that the construction sector lost 3,000 jobs between July and August, which the association attributed, in part, to “ongoing declines in nonresidential” building and infrastructure segments where jobs have shrunk for five consecutive months. Total construction employment in August stood at 7,416,000.

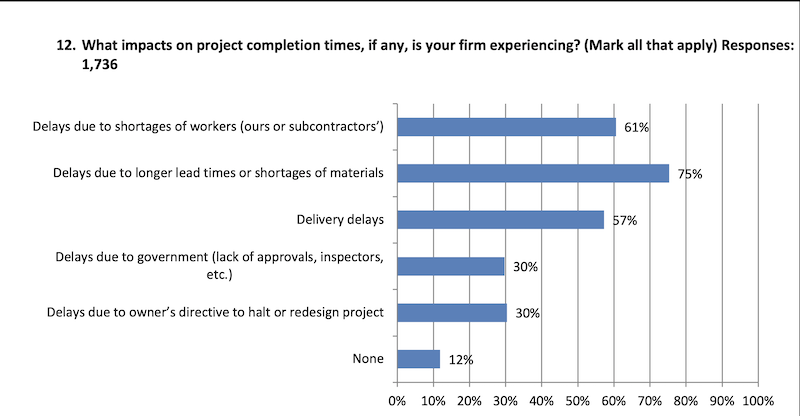

The AGC-Autodesk survey shows that contractors are drawing from a shallower pool of qualified workers. And that’s leading to project delays and affecting completion scheduling.

The AEG-Autodesk survey’s findings, which the association’s chief economist Ken Simonson summarized during the ZOOM call, were sobering. they included the following:

•88% of the companies polled are experiencing project delays, and three-quarters of respondents specifically cited longer lead times or materials shortages as culprits.

•More than half of those polled (51%) report projects that had been cancelled, postponed, or scaled back due to rising costs.

•Fewer than half (46%) said their companies’ volume matched or exceeded the level of a year ago, and 28% thought their recovery might take longer than six months.

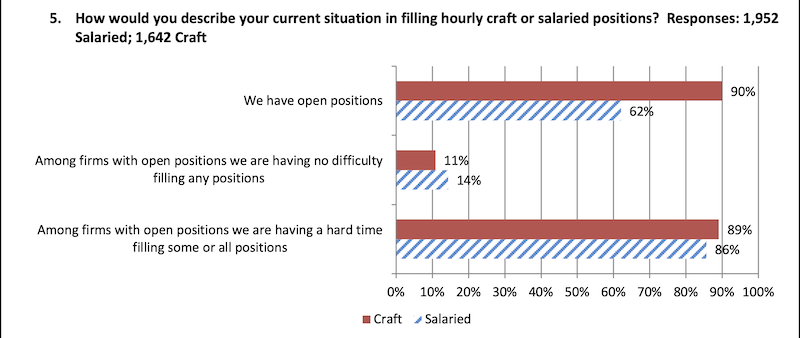

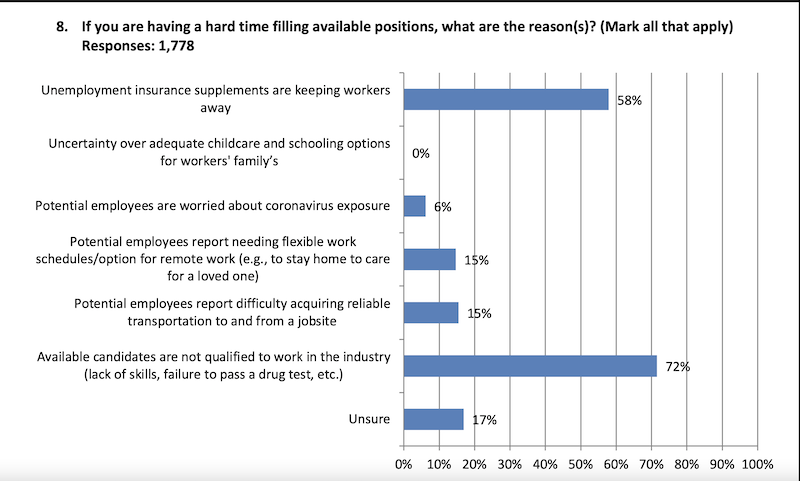

Most firms say they are eager to hire and expect to add new employees over the next 12 months, even though nearly nine of 10 respondents also conceded they were having difficulty finding craft workers to fill existing positions. More disconcerting was the 72% of respondents who said available job applicants weren’t qualified to work in the industry.

Respondents also complained that supplements to unemployment benefits were keeping qualified workers away from jobs. A smaller percentage (6%) say the fear of coronavirus exposure on the jobsite was hamstringing projects.

TECHNOLOGY EASES PROJECT MANAGEMENT

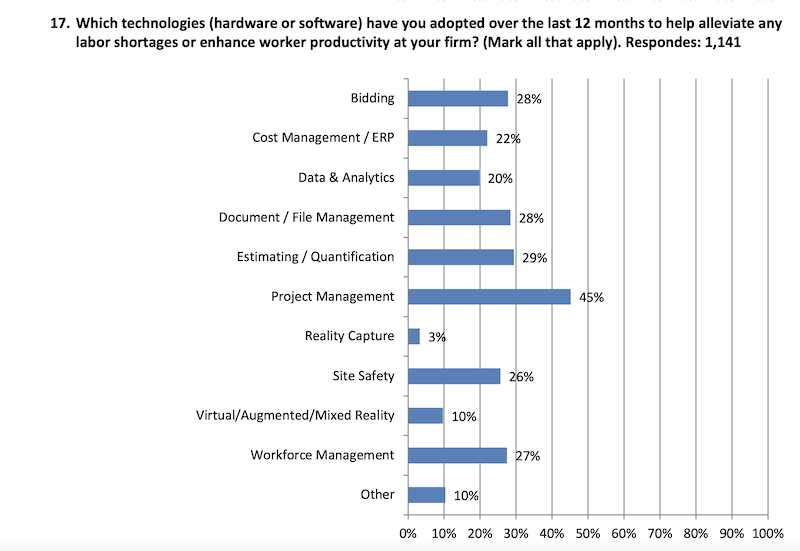

Technology is being relied upon more to help contractors manage projects with fewer workers.

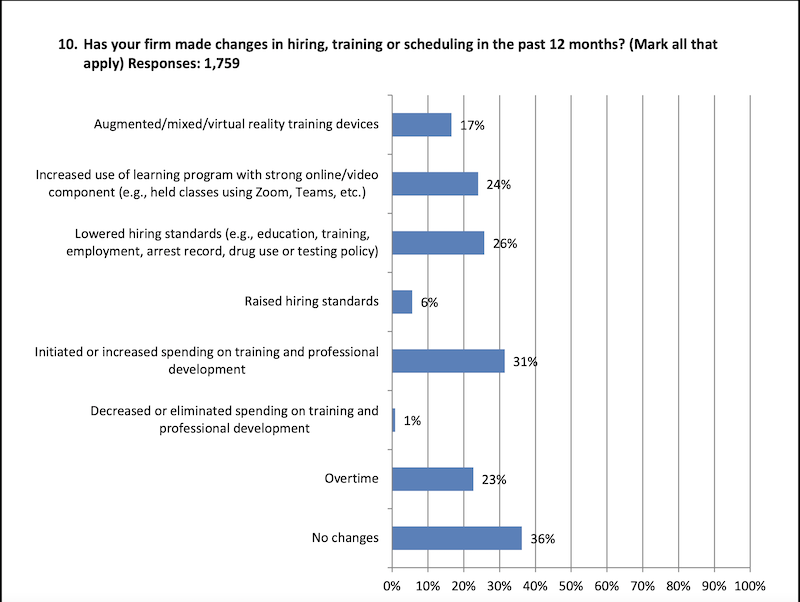

The industry’s chronic worker shortages have compelled construction firms to rethink how to attract new blood. Nearly one-third of those polled are now spending more on training and professional development. Another 37% are engaged in career-building programs at the high school, collegiate, and technical school levels.

Firms are also turning to technology, Neary three-fifths—57%—of respondents said that the adoption of technology had increased at their firms over the past 12 months. Around the same percentage expects the rate of technology adoption to increase over the next year.

During the ZOOM call, Allison Scott, Autodesk’s Director of Construction Thought Leadership and Customer Marketing, said that her company had seen a 150% increase in the application of its Project Management software over the past year. (About 45% of the survey’s respondents have adopted project management software.)

Scott implied that tech-savvy contractors might have a better shot at attracting younger workers at a time when “construction has an image problem in attracting emerging talent.”

Strassel admitted that, prior to the pandemic, he would roll his eyes at some of the suggestions about how to get Millennials interested in the construction arena. But as the worker shortage problem has gotten worse, he’s having second thoughts. Last year, Hedrick Brothers hired a consultant and set up a task force to strategize how to make the company and its jobs more appealing to younger workers. “We can’t ignore an entire generation,” he said.

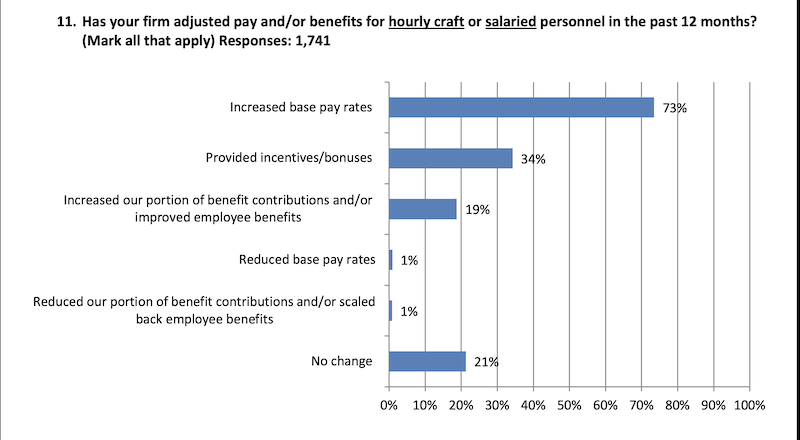

Improving compensation and better training are among the measures that contractors have taken to make their companies and jobs more attractive to potential employees.

ASSOCIATION URGES FEDERAL ACTION

AGC wants the federal government to spend more on career training to get younger people interested and prepared for construction employment.

The two contractors on the ZOOM call said that the pandemic’s impact on projects mostly revolved around getting workers vaccinated. Carson acknowledged that subcontractor resistance to vaccination “has made life difficult” for his company on certain projects, particularly hospital construction and renovation where worker vax is mandated. Sandherr pointed out, too, that contractors can’t impose mandates on union workers, and he questioned whether contractors should be put in the position of becoming “health police” monitoring sub compliance.

Neither Carson nor Strassel said his company plans to make vaccinations mandatory for workers or subs. Both sounded more concerned about ongoing supply-chain delays, “which are subject to change every day,” said Carson, and are not likely to be resolved quickly, lamented Strassel.

Nationally, about half of all construction workers have been vaccinated. AGC has been encouraging workers to get the shot, and has been instrumental in establishing jobsite safety protocols.

To mitigate worker shortages, AGC has also launched a targeted digital ad campaign that promotes the construction industry. And its “Culture of Care” program is designed to help contractors retain workers. “We’re doing what we can,” said Sandherr during the ZOOM call.

AGC thinks Washington could be doing more, too. Sandherr noted that the federal government spends only $1 on career training for every $6 it spends on college prep, when only one in three jobs requires a college diploma. The association is also urging the House of Representatives to pass the $1 trillion bipartisan infrastructure bill, which the Senate has already passed. (A House vote on that bill is scheduled for Sept. 27.)